IMPORTANT:- Some links in this article will only be accessible to authorised Members that have logged into the Exchange Trade Centre

Once you have read and understood the article that explains the Credebt Exchange® charges, understanding the true cost of funds is very simple. Login to the Exchange Trade Centre | Dash Board and select the Transaction Statement menu item from the left side menu. The Transaction Statement shows the overall cost of funds for each Debtor and the Exchange Statement for the specific Debtor shows the actual cost of funds for each ETR Trade.

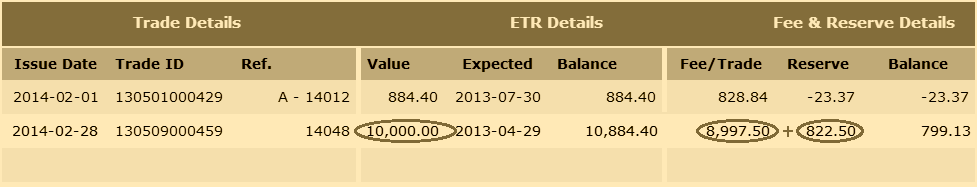

Taking the simple example of an invoice/ETR with a Face Value of €10,000 with an Expected Date 60-days later, where the Originator has agreed an RSA with a 90% Purchase Price and 0.875% discount per month. In the example below, under the Fee/Trade column on the Transaction Statement the Purchase Price of 90% is shown as being paid to the Originator for the Traded ETR, i.e. €9,000.00 less the processing commission, or €8,997.50.

In the example above, under the Reserve column on the Transaction Statement the amount due when the ETR is Settled will be €822.50. When the ETR was purchased, 90% was paid and this leaves a balance of €1,000.00 on the Face Value of the ETR. When the ETR is Settled, a portion of this balance, called the Reserve, is payable to the Originator. The Reserve can be calculated by multiplying €10,000.00 by 0.875% which equals €87.50 and because this is a 60-day ETR, the discount charge will be €87.50 by 2 (to represent the two months the ETR outstanding), or €175.00.

When paying the Reserve to the Originator, the processing commission is automatically deducted. Therefore, to calculate the cost of funds in this example, the Originator takes the Face Value of €10,000 and subtracts the Purchase Price of € 8,997.50 and the Reserve of €822.50 to get the total cost of €180.00 as seen below:

Total Cost of Funds = Face Value – Purchase Price – Reserve

180 = 10,000.00 – 8,997.50 – 822.50